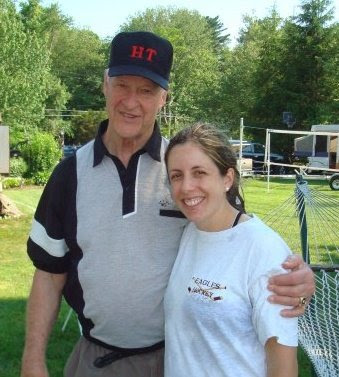

MOVERS AND SHAKERS: Seaver Wang, CEO of Karagosian Financial Services

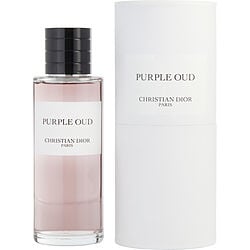

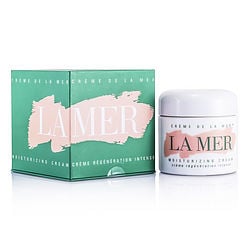

This Mover and Shaker interview is brought to you by Peachy's Sweet Deals:

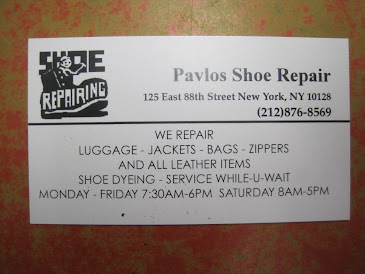

Be sure to visit Cosmopolitan Dental, Sistina, Caravaggio and Cutler Salon to measurably improve your life!

Seaver Wang grew up in Orange, Connecticut where he attended the Hopkins School, a prep school in New Haven. He earned his BA from Boston College and worked as an equity analyst for Value Line, Inc. in New York City after graduation. There, he learned the ins and outs of securities analysis. Mr. Wang later enrolled in the Boston University MBA program to further his studies.

Upon graduation, he went to work as an equity analyst at Sidoti & Company, the largest institutional small-cap research firm in the country. Sidoti & Company was still a fairly young firm and Mr. Wang also learned the intricacies of growing the sales and trading business in addition to being a leading Industrials sector analyst. Yearning for more responsibility and greater potential rewards, Mr. Wang hoped to replicate his past success at Utendahl Capital Partners, one of the countries leading minority firms, which had no existing equity research product. There, he established himself as one of the top small- and mid-cap industrial and manufacturing stock analysts and helped establish the equity research department. He repeated the same process at HFP Capital, a start-up investment bank, but tiring of building businesses for others, Mr. Wang decided to go off on his own, acquiring Karagosian Financial Services, a 25 year old investment practice.

Karagosian Financial is a fee-based firm that specializes in managing investments for high net-worth individuals through separately managed accounts. Unlike most advisors, Mr. Wang also does his own individual securities analysis and portfolio management, in addition to traditional asset allocation. His services include equity-only investment strategies that attempt to beat the S&P 500 or their respective benchmarks, as well as goal-based portfolios for such things as retirement or college. Karagosian Financial is currently located at 315 5th Avenue and more information can be found at the company website at www.Toinvest.com.

Mr. Wang is also heavily involved in a number of non-profit organizations in Manhattan, including the Soldiers, Sailors, Marines, Airmen’s, & Coast Guard Club, which offers affordable rooms for visiting service men in Manhattan, and the Quadrille Ball, which raises scholarship money for American and German exchange students.

We are absolutely thrilled to present Seaver Wang as our latest Mover and Shaker.

Peachy Deegan interviewed Seaver Wang for Whom You Know.

Seaver Wang: I was in the stock market club in high school but I didn't really get into investing until I read Peter Lynch's first book " One Up On Wall Street", after my freshman year. Coincidentally, Peter Lynch also attended Boston College, my alma mater.

[Note: Mover and Shaker Sascha Rothchild's father, John Rothchild, wrote Peter Lynch's books. Peachy has known both Sascha and Seaver since freshman year at BC.]

How do you begin an Equity Research department as you did at Utendahl?

I had established some relationships with institutional money managers and they continued to value my work, regardless of what firm I was with. We started off with essentially a blank slate. The proper procedures had to be put in place, such as compliance with FINRA, editing and approval of research reports, etc. My co-worker and I had even re-designed a very rudimentary template for reports. The trading desk was already established which helped.

What should most investors know about the market in today's economic climate that most do not understand or consider?

We've had a very difficult three years in the markets and there is a lot of fear out there. Right now, I don't think the markets are very rational. Many public companies are doing pretty well right now and are in the best financial shape they've been in for decades, but fear persists because the average american does not feel secure. So right now the markets do not reflect many company's fundamental strengths. People often pay too much attention to the daily news which provide good headlines but often have little value in the investment process.

What are the keys to being a successful investor and identifying a great investment?

We perform our own research at Karagosian Financial Services and try to see what the important issues are that affect a company's fundamentals. It takes patience, but sometimes there are obvious bargains out there. We look for companies who's stocks may be down because of temporary bad news. The most important thing is to have a strategy that makes sense and works. These are strategies that have stood the test of time, usually decades. Also, you have to have the discipline to stick with the strategy, even if it is currently not working perfectly. The newest investing fads are exactly that... temporary fads.

How did you become involved in each of the charities you support and what do you love most about your charitable endeavors?

New York City is a very transient place and over the years whole groups of friends of mine have moved away. I was looking to make new friends and an acquaintance of mine told me about an old traditional charity ball called the Quadrille Ball that was a white tie event. I never heard of "white tie" and was intrigued, so I volunteered. Through friends I made at the Quadrille Ball, I was introduced to the SSMAC (Soldiers, Sailors, Marines, Airmen's, Coast Guard Club). Their credo is "Serving those who have served". The club is in midtown and offers affordable accommodations for service men and their families. Our job is to raise money to continue running the hotel and to essentially be their welcoming party in NYC. Since I have never served in the military this was my way of honoring our service men and women. I don't have one favorite experience.

What or who has had the most influence on your pursuit of excellence?

I attribute my pursuit to excellence to my parents. My parents instilled in me the value of continuously improving oneself and practiced what they preached. I think that is why I chose my current career path. Even though the basics of successful investing remain the same, there is an infinite amount of information that one can always learn from.

What are you proudest of and why?

I'm most proud of the way I handle myself in business and in life, both ethically and morally. I always try to do the right thing, even if it might be potentially detrimental to my personal goals. I'm not ignorant of the fact that people are still very human and often self serving, but that type of behavior often leads to trouble in the future. Look at Bernie Madoff and all the other scam artists in my industry. I take pride in knowing that I'm doing the right thing for my clients. I think this has also led to long lasting relationships in my personal life.

What would you like to do professionally that you have not yet had the opportunity to do?

There is quite a bit I'd like to do professionally. Acquiring Karagosian Financial Services was just the beginning. I'd like to start a mutual fund or family of mutual funds in the future when we get larger, and possibly a long/short hedge fund. There are a number of other products and services I'd like to expand into.

What honors and awards have you received in your profession?

I always worked at boutique firms that many of the large media outlets ignored, but based on my personal performance as an analyst, I received five-star ratings by Starmine for the coverage of some of my companies. I was also highly rated by Bloomberg's rating system of analyst against my respective peers.

What is your favorite place to be in Manhattan?

I don't have a favorite place. Its more about the people you are with.

What is your favorite shop in Manhattan?

I like Duane Reades. I like the variety.

What is your favorite drink?

Any lager.

What is the funniest thing that has ever happened to you at a cocktail party?

This probably wasn't the funniest, but at one of the charity balls I attend, friends of mine saw the photographer from the NY Times. He was very interested in shooting photos of my wife and her friends and I tried to be in the pictures too, but every time I showed up in the frame he was not interested in taking the picture. Its cool to be able to see a photo of yourself in the NY Times "Styles" section but I've never gotten in there. My wife has been in it twice, already.

What is your favorite restaurant in Manhattan?

It's hard to choose, but one of my favorites is Wolfgangs's Steakhouse.

What is your favorite Manhattan book?

I tend to read about various financiers who have written books and live in Manhattan, but I don't have a favorite.

If you could have anything in Manhattan named after you what would it be and why?

Having a park named after me would be nice.

What has been your best Manhattan athletic experience?

I recently had a guy's outing at Chelsea Piers where we played an assortment of sports, including beach volley ball, jousting in a boxing ring, and navigating an obstacle course.

What is your favorite thing to do in Manhattan that you can do nowhere else?

Brunch or after-work drinks. Its so convenient and a large group of people can join. I always say that tourists come here to see the buildings and monuments, but the true beauty of Manhattan is its everyday life.

What has been your best Manhattan art or music experience?

I enjoy going to the Metropolitan Opera House or Broadway shows. Its always world class.

What do you personally do or what have you done to give back to the world?

I give back through the charities I'm involved in, but I also like to give advice to younger people about entering the world of finance.

What do you think is most underrated and overrated here?

The most underrated in NYC is how nice people are here. New York has a reputation for being rude, but its not true. People are rude everywhere but often in New York people misconstrue focus as rudeness. The most overrated thing around here are probably the night clubs. Most Manhattanites don't regularly go to these mega clubs. Its more for tourists or people from the suburbs who come in and don't know where the real cool places are. Its usually overpriced and overcrowded for what you pay for. Plus, when I was younger, I went to Ibiza, and there are no clubs in the world that can compare to that place.

Other than Movers and Shakers of course, what is your favorite Whom You Know column and what do you like about it?

Peachy's Picks-I really enjoy the restaurant reviews.

Have you drank The Peachy Deegan yet and if not, why not?

I did drink the Peachy Deegan at a restaurant close to my apartment called Le Mediterranee.

What else should Whom You Know readers know about you?

Not much, just that what you see is what you get.

How would you like to be contacted by Whom You Know readers?

I can be reached at 212-213-1898 and my E-mail is Swang@toinvest.com. Please give me a call for a free consultation.