MAYOR BLOOMBERG ANNOUNCES NEW $5.5 MILLION MATCHING GRANT PROGRAM FOR SMALL BUSINESSES IMPACTED BY HURRICANE SANDY Mayor’s Fund to Advance New York City and Partnership for New York City Providing Grant Money, Which Will Supplement City's Existing Low-Interest Loan Program

Mayor Michael R. Bloomberg today announced a new program that will make available $5.5 million in matching grants for New York City businesses most impacted by Hurricane Sandy. This grant program – which is being funded with $5 million from the Mayor’s Fund to Advance New York City, as well $500,000 from the Partnership for New York City – will be administered by the New York Business Development Corporation and was developed in collaboration with the City’s Economic Development Corporation and Department of Small Business Services. The matching grants are designed to provide additional financial assistance for local businesses already seeking low-interest loans through the City’s existing Emergency Loan Fund. The Mayor also announced today that in addition to the $10 million Emergency Loan Fund launched by the City and Goldman Sachs immediately following the storm, an additional $5 million has been committed to the loan fund by a consortium of New York financial institutions through the New York Bankers Association, bringing the total amount of loans, grants, and other financial assistance available to businesses most affected to more than $45 million.

“Getting New York City small businesses back on their feet is key to helping our economy recover from Sandy,” said Mayor Bloomberg. “The capital provided through this program will help businesses purchase supplies, make repairs, and get back up and running.”

“The Bloomberg Administration is committed to helping small businesses impacted by the storm reopen, put New Yorkers back to work, and provide critical services for impacted communities as quickly as possible,” Deputy Mayor Robert K. Steel said. “Getting these businesses up and running again after Sandy is critical to the City’s overall recovery, and with this expanded toolkit of loans, grants and other savings programs, we will be able to help even more businesses get back in business sooner.”

“With today’s announcement, businesses across the five boroughs will have a greater opportunity to access emergency funds that will enable them to get back on their feet,” said New York City Economic Development Corporation President Seth W. Pinsky. “Thanks to our partnerships with the Department of Small Business Services, Goldman Sachs, the Partnership for New York City, the New York Business Development Corporation, and now the New York Bankers Association and the Mayor's Fund, more than $45 million has been made available to businesses to assist in their recovery from the effects of Sandy, ensuring they continue to make important contributions to their communities and the City as a whole.”

“So many people have stepped up to help small businesses impacted by Hurricane Sandy get back on their feet, and word is getting out. We are starting to get funds out through the City’s Emergency Loan Fund, and there are hundreds more applications in the pipeline,” said Rob Walsh, Commissioner of the NYC Department of Small Business Services. “In addition to the low interest loan and other assistance services, these grants will be key to further helping the City’s businesses recover. I thank the Mayor’s Fund to Advance New York City, the Partnership for New York City, and the New York Banker’s Association for their generous contributions, and SBS will continue to work with NYCEDC and other public and private partners to serve New York City’s small businesses.”

“The impact of Hurricane Sandy continues to take a toll on communities throughout New York, and our City’s small business community is among them,” said Mayor’s Fund Advisory Board Chair Rob Speyer. “Our small businesses are a vitally important part of our City's lifeblood and economy and I want to thank the Mayor’s Fund donors for their generosity and commitment during this difficult time.”

“The effects of Hurricane Sandy on small businesses in Lower Manhattan have been particularly dramatic. Those lucky enough to escape physical damage are now forced to endure a steep decline in business throughout the area,” said Maria Gotsch, President and CEO of the Partnership for New York City Fund. “The additional half a million dollars in funding from the Partnership will help businesses repair equipment and restock inventory, providing them the necessary resources to stay afloat in their time of need. These funds come directly from businesses who were able to rebuild after 9/11, with the help of the Partnership, and paid back their loans in order to help others. It shows that when New Yorkers help each other, it often comes back full circle.”

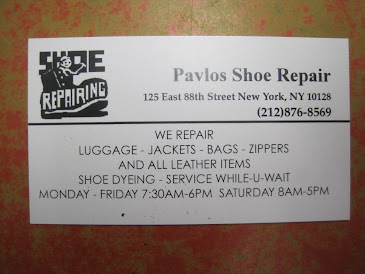

The new matching grants of up to $10,000 will be administered by the New York Business Development Corporation and will be available to New York City businesses in all five boroughs that have been displaced from their workplace for three weeks and are already seeking emergency loans from the City’s existing program. They are designed to provide critical supplemental assistance to what is being provided through the low-interest loans, and will be capped at no more than the amount the business receives in the loans. The grant program may increase based on evaluation of future need, and donors interested in supporting these efforts are encouraged to contact the Mayor’s Fund. Businesses that have already begun the process of applying for a loan will be eligible to receive grants retroactively. The $500,000 provided by the Partnership for New York City will be specifically earmarked for impacted businesses in Lower Manhattan. Businesses south of Canal Street with fewer than 100 employees that demonstrate need will be eligible for up to $10,000, which will be on top of the $25,000 available through the existing Emergency Loan Fund. The $500,000 has been allocated from funds that were originally received from The September 11th Fund—created by The United Way of New York City and The New York Community Trust—that helped capitalize a program that the Partnership ran to help small businesses recover from the World Trade Center attack in 2001. Many of those recipients were able to get back on their feet and repaid their grants so that the funding can be used a second time to help other small businesses in Lower Manhattan.

In addition to the new matching grant program, the City has also received an additional $5 million for its Emergency Loan Fund, provided by a consortium of local banks through the New York Banker’s Association. This contribution will build upon the fund which Goldman Sachs and the City created in the days following the storm, including identifying the lender and structuring the fund so that it could easily accommodate funds from other lenders. This additional $5 million will bring the total loans available to impacted New York City businesses to $15 million. The banks offering this additional assistance are: Bank of America, Capital One Bank, TD Bank, First Niagara Bank, Flushing Financial, M & T Bank, People's United Bank, NBT Bancorp, Hudson Valley Bank, Valley National Bank, First National Bank of Long Island, Popular Community Bank, Provident Bank, Mahopac National Bank, Northfield Bank, NYBDC, Suffolk County National Bank, Ridgewood Savings Bank, Country Bank, Westchester Bank, Pathfinder Bank, Glens Falls National Bank, Ulster Savings Bank, Tompkins Financial Corp., and Saratoga National Bank.

The Emergency Loan Fund has already been providing up to $25,000 a piece to small businesses that experienced direct damage through flooding or power outages with capital to cover working capital, repairs and equipment replacement, among other things. The Emergency Loan Fund has already made significant progress: 194 loan applications have been submitted to the lender, 398 loan applications are underway and 7 loans have been approved. Loans are interest free for the first six months and 1% interest for up to 24 months. SBS through its NYC Business Solutions Centers has already been working to coordinate with community-based-organizations in severely affected areas to help businesses with the application process. For more information or to apply, businesses can call 311 or go to www.nyc.gov/nycbusiness.

The additional contribution to the Emergency Loan Fund will build upon the original $10 million made available by the New York City Economic Development Corporation and Goldman Sachs in the days immediately following the storm. Goldman Sachs, through their Urban Investment Group, generously matched the City’s $5 million contribution, doubling the pool that has already been available to businesses in recent weeks.

“After Hurricane Sandy hit, we saw the immediate need to get capital into the hands of New York City small businesses to get their business up and running again,” said Alicia Glen, Head of the Goldman Sachs Urban Investment Group. “We worked side by side with the City to launch a loan fund to allow hundreds of small businesses to get back on their feet and in turn help the local economy recover as well.”

“NYBDC has been providing creative and responsive financing solutions to NYC small businesses since 1955,” said Patrick J. MacKrell, President and CEO of NYBDC. “We are honored to have the opportunity to donate our resources to the management of this Fund and to support the critical needs of NYC small businesses impacted by Sandy.”

“The New York Bankers Association and its member banks have stepped up to the call to help Sandy victims by bringing immediate relief to small business owners through an emergency loan program on line today,” said Michael P. Smith, President & CEO, New York Bankers Association. “This emergency lending program is doing what banks do best – provide support to our communities.”

"Bank of America is dedicated to helping those impacted by Hurricane Sandy,” said Jeff Barker, New York City President for Bank of America. “That's why, along with other financial services companies, we made a commitment to the recovery loan fund to support small businesses in New York as they rebuild. We have an opportunity to help make a difference and this is one way we're doing it."

“TD Bank is proud to lend our support to this important effort which will assist in restoring and supporting businesses as Hurricane Sandy recovery moves forward,” said Chris Giamo, Regional President for New York and Northern New Jersey, TD Bank. “Our thoughts are with those who have been affected by this natural disaster and we look forward to seeing the results of this investment in the greater New York Community.”

The new $5.5 million grant program and the now $15 million Emergency Loan Program are part of the City’s larger suite of initiatives - announced by SBS and NYCEDC immediately after Hurricane Sandy - to assist impacted businesses across the five boroughs. Emergency sales tax letters from New York City Industrial Development Authority (IDA) are also available offering a waiver of up to $100,000 in New York City and New York State sales taxes to businesses on materials purchased for recovery efforts. This program is available to a maximum of 250 businesses for reconstruction projects costing $500,000 or more. IDA will also waive all fees and, while following State law, look to streamline its normal procedure. Altogether, the grants, loans, and sales tax waivers available will total nearly $50 million for New York City businesses to access in order to get back on their feet following the storm.

NYCEDC has also secured more than 250,000 square feet of additional temporary office space across the five boroughs, as well as donated services, for displaced businesses. For a list of available space, supplies, or other services available through generous donations, visit www.nycedc.com/donations.

Federal assistance is also available to small businesses in need of up to $2 million. These affected businesses can apply for a Disaster Assistance Loan through the U.S. Small Business Administration (SBA). SBA Business Recovery Centers are stationed, among other locations, at NYC Business Solutions Centers, to help connect small businesses to applications. NYC Business Solutions staff can also help with technical assistance for loan applications. SBA representatives are currently at the NYC Business Solutions Brooklyn and Lower Manhattan Centers and are working on locating in other Centers, as well. For more information on SBA Disaster Assistance Loans, go to www.sba.gov.

For employers with workers who lost their jobs or have reduced hours due to the hurricane, the New York State Department of Labor (DOL) is offering Disaster Unemployment Assistance, supplementing New York’s existing unemployment insurance system and expanding eligibility to include individuals who might otherwise not be covered. Coverage includes employees and self-employed people such as small business owners, independent taxi drivers, and vendors unemployed due to hurricane-caused injury, damaged workplace, lack of transportation, and more.

The SBS Business Outreach Team’s Emergency Response Unit (BOT/ERU) has also been assessing damages in severely impacted areas in order to best respond to needs. BOT/ERU helps businesses recover after an emergency by offering services including: expediting re-inspection, application, and permit processes; replacing lost or damaged City permits or paperwork; resolving issues with insurance by working with the New York State Insurance Department; accessing free legal services; and connecting businesses to tax abatements for reconstruction, utility rebates, and other incentives.

Impacted businesses should list everything that was lost or was damaged, take the highest quality photos possible to document everything, use a person to point at a water line on the wall or a fixed appliance/equipment, try to assess the value of each item and if invoices/receipts are available, keep them to document value, and discard perishable/dangerous items, but keep everything else in a safe place to show to insurance companies.

All businesses in need of assistance due to Hurricane Sandy should contact NYC Business Solutions by filling out a Contact an Account Manager form at www.nyc.gov/nycbusiness, calling 311 and asking for “NYC Business Solutions” or visiting one of the City’s Restoration Centers.

The Mayor’s Fund to Advance New York City, a 501(c)(3) nonprofit organization dedicated to innovative public-private partnerships and programs for the City of New York, is accepting financial donations to support hurricane relief efforts. One hundred percent of donations are being dispersed to relief efforts and organizations. Grant funds have helped to support the supply and transport of emergency needs including hot food, toiletries, baby supplies, cleaning materials, warm clothing and medications to communities hit hardest by the hurricane. The Mayor's Fund is also committed tolonger-term rebuilding and restoration efforts including assistance for displaced families, schools, small businesses, nonprofit organizations, parks and other impacted groups. To donate go to www.nyc.gov/fund or call 311.